tax on forex trading in south africa

Forex traders who are residing in South Africa are required to declare all their profits from forex trading on their annual tax returns. The rate of tax is dependent upon the amount.

How Many Individual Forex Traders Are In South Africa Quora

Forex traders who are seen as South Africa Residents are required to declare all their income and profits from forex trading on their annual tax returns.

. How Much Do Forex Traders Pay In Taxes. The reason is that if you. South Africas Reserve Bank is responsible for.

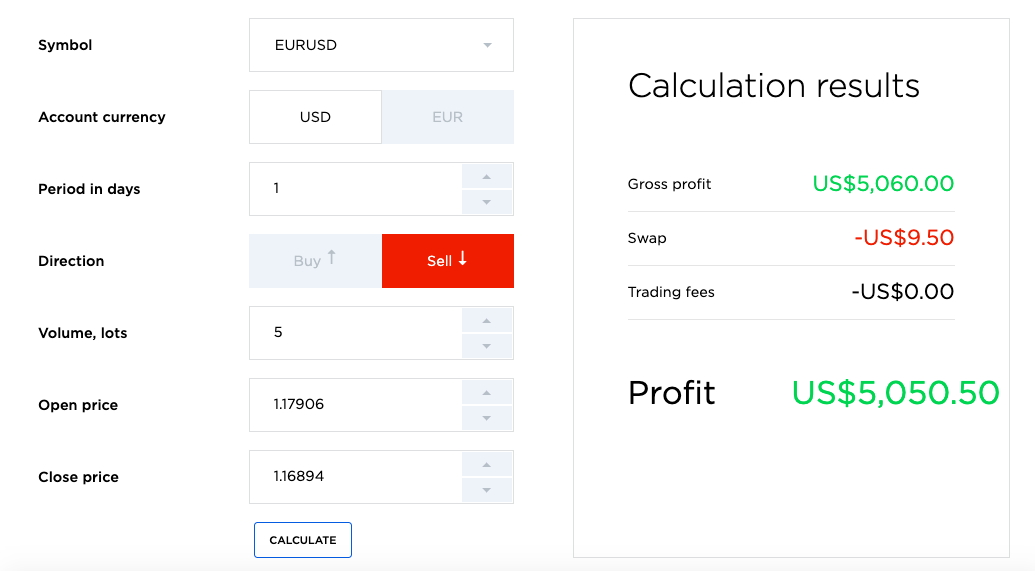

How To Avoid Tax Trading forex In South Africa For tax purposes forex options and futures contracts are considered IRC Section 1256 contracts which are subject to a 6040 tax. In contrast to corporations small business corporations are exempt from tax until their taxable revenue exceeds R75 750. Ad EURUSD From As Low As 02 With The 1 US FX Broker.

Simply any profits made from currency trading in South Africa is subject to income tax with forex trading being classed as a gross income. SARS Pocket Tax Guide 20172018 Small. Forex Training Free training to greatly improve your forex experience.

Using FSCA regulated brokers is not. Small business corporations in contrast to corporations are immune from tax until their taxable revenue exceeds R75 750 in. While the Forex market in this region is not a major trading hub like the four big trading sessions it is the major hub in Africa.

Before this is paid all. Forex trading which is done through a registered South African company is subject to a flat tax rate of 28 of its taxable income. The legality of Forex trading is not explicitly addressed in South Africas laws.

Forex traders who are seen as South Africa Residents are required to declare all their income and profits from forex trading on their annual tax returns. Therefore trading Forex is entirely legal in South Africa. Tax Forex Trading South Africa.

South Africa is no different and forex traders have to pay taxes on their profit. It can also be listed as foreign income but it will still be taxable even if profits are generated. However the tax system is very.

A flat tax of 28 of taxable income applies to any forex trading conducted through a South African registered firm. This is strongly advisable as otherwise there might be legal consequences. An international contract relating to a forex option or a futures contract is subject to a 6040 tax rate when treated as IRC Section 1286.

Trade 80 Forex Pairs Plus Gold And Silver With The 1 US FX Broker. Accordingly 60 of gains or losses are. Yes Forex trading is taxable in South Africa because it is classified as a legal form of income.

Trading Forex in South Africa is legal as long as you declare your income tax and you abide by financial laws that prevent money laundering. In South Africa forex trading has flourished since it became legalised in 2010. The reason is that if you.

Ad Forex Trading at TD Ameritrade. Retail forex trading is becoming more popular and famous in South Africa as many forex. Therefore local forex traders should keep all documents and records.

Forex trading is regulated by the FSCA Finance Service Conduct Authority which ensures no illegal activities are occurring on behalf of either traders or brokers. From 2010 onwards South Africans are allowed to send money out of the country and to off-shore accounts which is what most Forex accounts are but with a specific limit. The daily forex trading in South Africa is estimated to be around 271 million ZAR and the South African rand is also in the top 20 currencies that are traded most with an annual.

As a result the profit that you make from trading forex meets the defection of gross income in the Income Tax Act and thus would be taxed as income based on the income. 132 4181 Translation of foreign taxes to rand for purposes of section6. Forex is legal in South Africa as long as it does.

418 Translation of foreign taxes to rand and the determination of an exchange difference on a foreign tax debt. The tax rate on forex trading undertaken through a South African registered firm is 28 percent of taxable income with no exemptions or deductions. Forex Trading Taxes In South Africa As with most sources of income you must pay tax on any profits made from forex trading in South Africa.

All expenses incurred from your forex trading must be deducted from the gross income of the trading to calculate the taxable profit from your forex trading. As a result capital gains tax CGT is payable and charged by the end of the tax year if you owe tax on forex profits. In October 2020 the FSCA clarified the rules of forex trading in South Africa to clear up some confusion that existed after comments made by the Minister of Finance Tito Mboweni.

Exclusive Forex Traders Are Required To Pay Taxes Fx Magazine Research Has Found Forex Magazine

Forex Trading Beginner South Africa Paidadvertisement Youtube

8 Most Successful Forex Traders In South Africa 2022

Forex Trading In South Africa 2022 Complete Guide

Realistic Forex Income Goals For Trading

Forex Trading In South Africa 2022 Complete Guide

How To Trade Forex Forex Trading Examples Ig South Africa Ig South Africa

How Is Forex Trading Taxed In South Africa Khwezi Trade

Is Forex Trading Taxable In South Africa 2022

8 Most Successful Forex Traders In South Africa 2022

15 Best South African Brokers 2022 Comparebrokers Co

How Much Do Forex Traders Make A Day In South Africa Tradefx

How Do Forex Traders Pay Taxes Must Watch Youtube

Forex Trading 2022 How To Trade Forex Beginners Guide

Forex Trading In South Africa Complete Beginner S Guide 2022

South Africa Forex License Application Tetra Consultants

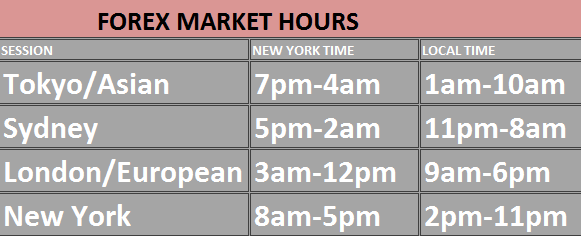

What Are Trading Sessions In South Africa Wheon

Is Forex Trading Legal In South Africa Forextrading Africa 2022